capital gains tax proposal details

Bidens campaign proposal regarding capital gainsthe details. Governor Inslee is proposing a capital gains tax on the sale of stocks bonds and other assets to increase the share of state taxes paid by Washingtons wealthiest taxpayers.

The top capital gains tax rate would be 25.

. House Democrats proposed a top 25 federal tax rate on capital gains and dividends. It would apply to single taxpayers with over 400000 of income and married couples with over 450000. Under current law such capital gains have a two-tiered structure.

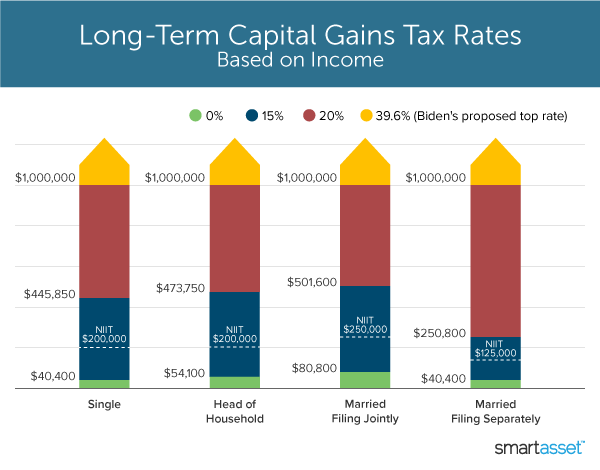

Real estate or business interests would not be taxed annually Wyden said but billionaires would still pay a capital gains tax including. In the American Families Plan AFP the Biden Administration is proposing an increased tax rate on capital gains and qualified dividends to equal the top ordinary income tax rate of 396 for households earning over 1 million or 500000 if married filing separately. President Joe Biden proposed a top federal tax rate of 396 on long-term capital gains and qualified dividends.

53 rows Under Bidens proposal for capital gains the US. Increasing the tax rate on capital gains from 238 percent to 434 percent taxing capital gains at death and applying the 38 percent NIIT to active pass-through income reduce long-run GDP by 02 percent accounting for about half of the total economic impact of the American Families Plan tax proposals. The House Ways Means Committee has released draft legislation of individual tax hikes they propose to pay for the 35 trillion social policy budget plan under consideration.

Democratic presidential candidate Hillary Clinton has proposed a change in the top capital gains tax rates. The proposal includes a 3 surcharge on individual income above 5 million and a capital gains tax of 25. Reform Corporate Income Tax Corporate tax levels directly affect economic activity in states and those with more competitive structures and rates are in much better positions to grow existing businesses and attract new ones.

Economy would be smaller American incomes. There are short-term capital gains and long-term capital gains and each is taxed at different rates. The plan would increase the top corporate tax rate to 265 from 21 impose a 3-percentage-point surtax on people making over 5 million and raise.

House Democrats on Monday proposed raising the top tax rate on capital gains and qualified dividends to 288 one of several tax reforms aimed at wealthy Americans to help fund a 35 trillion. The state would apply a 9 percent tax to capital gains earnings above 25000 for individuals and 50000 for joint filers. This legislation calls for increasing the top individual tax rate from 37 to 396 and raising the capital gains tax rate from 20 to 396 for taxpayers with incomes higher than 1 millionand even higher for those required to pay the net investment income tax.

The IRS taxes capital gains at the federal level and some states also tax capital gains at the state level. Short-term gains face a top rate of 434 percent including the 396 percent statutory rate plus the 38 percent investment income surtax and long-term gains defined as those with. Taxpayers with an income of over 1M could lose their preferential 20 treatment on long-term capital gains.

If this happens it means they would be taxed at ordinary income tax rates as high as 396. The top tax rate on dividends and long-term capital-gains would rise to 25 from 20 and would apply when income reaches 400000 for. The proposals would increase the after-tax income of the bottom quintile by about 152 percent in 2022 on a conventional basis which is largely driven by the expanded child tax credit CTC.

The tax rate you pay on your capital gains depends in part on how long you hold the asset before selling. Taxes long-term capital gains and qualified dividends at the ordinary income tax rate of 396. It includes major revisions to the estate tax capital gains taxes and the way retirement accounts are taxed.

Short-term capital gains are. The proposal would allow 100 of the net capital gains to be deducted. Tax long-term capital gains as ordinary income for taxpayers with adjusted gross income above 1 million resulting in a top marginal rate of 434 percent when including the new top marginal rate of 396 percent and the 38 percent Net Investment Income Tax NIIT.

The top 1 percent of earners would experience a 08 percent increase in after-tax income in 2022 due to a more generous SALT deduction.

:max_bytes(150000):strip_icc()/SchedD-59e44eca73a940459e36066f830ebf63.jpg)

Schedule D Capital Gains And Losses Definition

Capital Gains Taxes Explained Short Term Capital Gains Vs Long Term Capital Gains Youtube

Capital Gains On Home Sales What Is Capital Gains Tax On Real Estate Guaranteed Rate

How The Biden Capital Gains Tax Proposal Would Hit The Wealthy

2022 Income Tax Brackets And The New Ideal Income For Max Happiness

/SchedD-59e44eca73a940459e36066f830ebf63.jpg)

Schedule D Capital Gains And Losses Definition

Mr Best Is Here To Give Some More Details On History About Mutual Fund In India Awarenessfreehai Mutuals Funds Stock Market Mutual

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World

The 2022 Capital Gains Tax Rate Thresholds Are Out What Rate Will You Pay

What S In Biden S Capital Gains Tax Plan Smartasset

How Do State And Local Individual Income Taxes Work Tax Policy Center

2022 Income Tax Brackets And The New Ideal Income For Max Happiness

2022 Income Tax Brackets And The New Ideal Income For Max Happiness

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

Online Sole Proprietorship Registration Procedure Sole Proprietorship Business Structure Opening A Bank Account

How The Biden Capital Gains Tax Proposal Would Hit The Wealthy

President Obama Targets The Angel Of Death Capital Gains Tax Loophole Tax Policy Center

Long Term Capital Gain Calculator For Financial Year 2017 18 For Buildi Capital Gain Financial Term

/SchedD-59e44eca73a940459e36066f830ebf63.jpg)